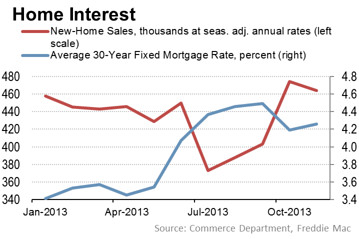

Climbing mortgage rates in 2013 corresponded with declines in home buying, a trend that could to some extent continue in coming months as interest rates adjust to shifts in the Federal Reserve’s monetary stimulus effort.

The average of 30-year fixed-rate mortgage interest rates so far this year compared against new-home sales illustrates that inversely proportional relationship: When interest rates go up, demand from would-be homeowners drops.

When rates as measured by Freddie Mac started rising in May of 2013 and averaged 3.54% for the month, the seasonally adjusted annual rate of new home sales dropped by 4% from the prior month, according to the most recent housing data from the Commerce Department. Meanwhile, in October, mortgage rates dropped by three-tenths of a percentage point just as new home sales surged 18%.

The trend could continue in 2016, experts said, especially if rates change significantly.

Source: http://blogs.wsj.com/economics/2013/12/27/mortgage-rate-swings-may-mean-bumpy-2014-housing-market/